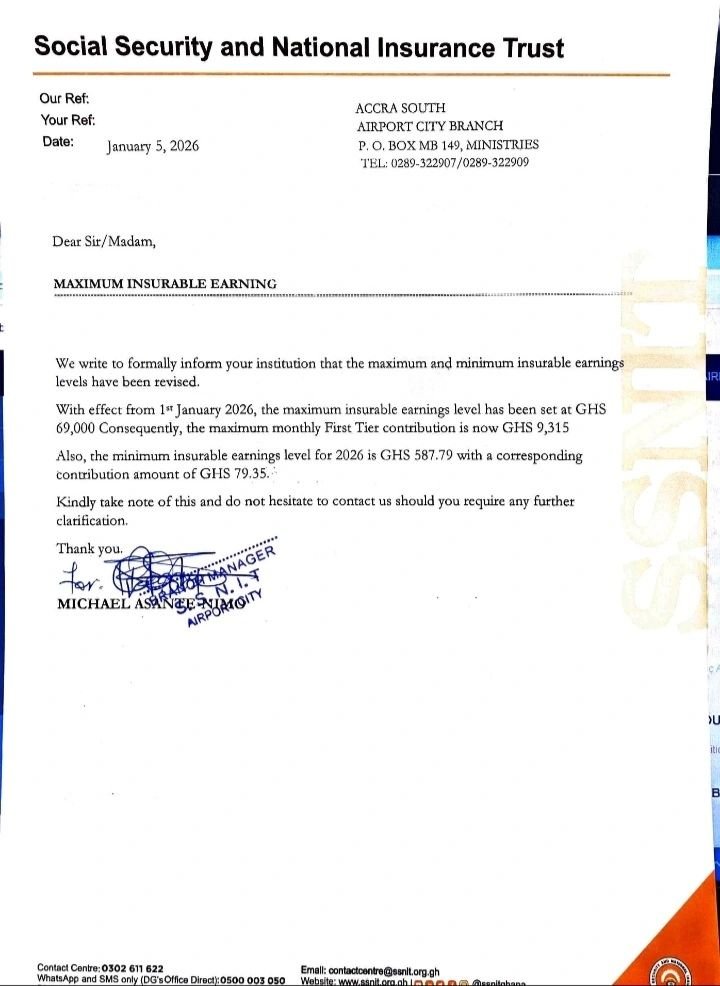

The Social Security and National Insurance Trust has announced the 2026 maximum and minimum insurable earnings or salaries. The maximum monthly insurable salary is GHS69,000. This translates into a monthly contribution of GHS9,315, which is 13.5% of the monthly salary. The minimum monthly salary is GHS587.79, which translates into a minimum monthly contribution of GHS79.35. This announcement means SSNIT will not receive monthly contributions lower than GHS79.35 and higher than GHS9,315.

Section 63 of the National Pensions Act, 2008 (Act 766) enables SSNIT to set the maximum monthly salary after consulting the National Pensions Regulatory Authority. The minimum salary is required to align with the monthly equivalent of the minimum wage. The 2026 minimum announced by the National Tripartite Committee on 9th November, 2025 is GHS21.77. The monthly equivalent is GHS587.79. This monthly equivalent is determined using 27 days of the month, that is GHS21.77 multiplied by 27. Section 76(1)(a) of the Labour Act, 2003 (Act 651) provides that:

Subject to this section, the minimum remuneration of a temporary worker or a casual worker shall be determined as follows:

(a) where a temporary worker or a casual worker is required to work on week-days only, the minimum monthly remuneration is the amount represented by the worker’s daily wage multiplied by twenty-seven

There is no maximum salary specified in Act 766 for Tier 2 and 3 schemes. So, contributions to private fund managers are to be capped based on SSNIT’s threshold. Further, in practice, Tier 1 contributions which exceed SSNIT’s threshold are added to the Tier 2 contributions. The salaries mentioned here are basic salaries. They do not include allowances.

Minimum wage and tax exemption

Usually, the monthly equivalent of the minimum wage is also exempt from taxes. This is reflected in the graduated tax table on the First Schedule of the Income Tax Act, 2015 (Act 896). The first band is taxed at 0% to show the relief given to those earning the minimum wage. The current monthly tax-free band is GHS490. This amount was determined using the 2024 daily minimum wage of GHS18.15. The last amendment to the tax table was in 2023 to capture the 2024 minimum wage. The 2024 and 2025 minimum wages have not been reflected in the tax tables. This means, anyone currently earning the minimum wage must pay taxes because while they earn a minimum of GHS587.79 in a month, the exempt income is GHS490.