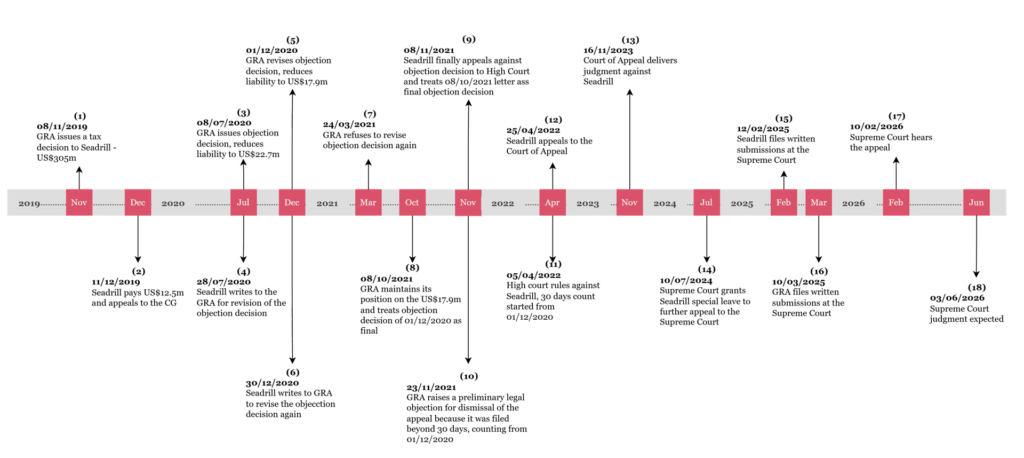

Yesterday, 10th February 2026, the Supreme Court of Ghana finally heard the appeal in the Seadrill v Commissioner-General dispute. The Court therefore adjourned to 3 June 2026 to deliver its judgment. This case is important as it clarifies the rules on the legal effect of correspondence between the taxpayer and the tax authority after a response has been given to an objection. The High Court and Court of Appeal say those correspondence have no legal effect. What will the Supreme Court say?

What the law says

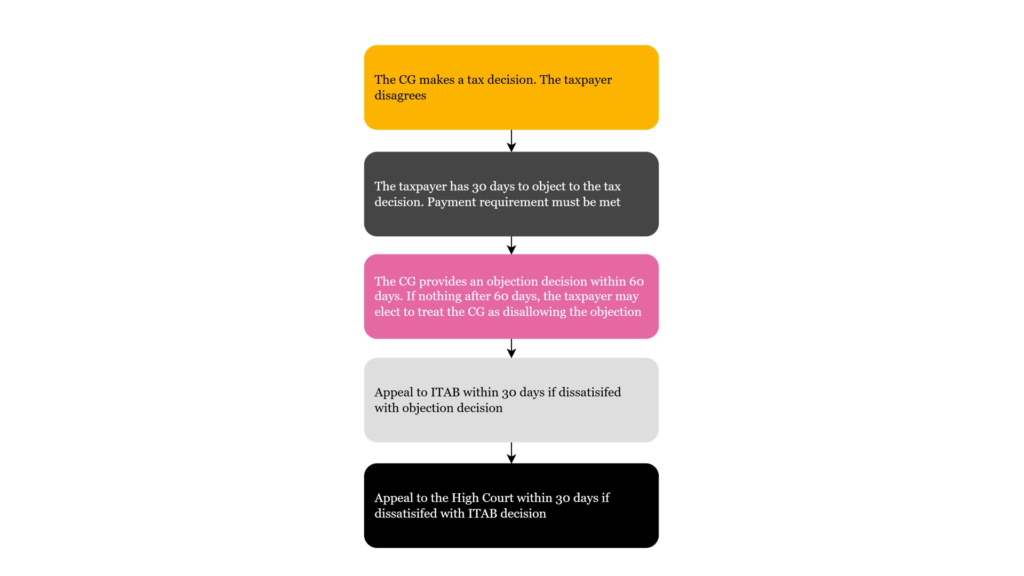

The Revenue Administration Act, 2016 (Act 915) contains the dispute resolution mechanism. Whenever the Commissioner-General makes a tax decision, the taxpayer is entitled to object to that decision. To do that, the taxpayer has 30 days to file the objection. If it is an assessment, the taxpayer must pay the relevant amounts first or request for a waiver or variation of the payment requirement.

When the objection is properly filed, the Commissioner-General has 60 days to issue an objection decision. If there is no objection decision after 60 days, the taxpayer can elect to treat the Commissioner-General’s silence as disallowing the objection. The taxpayer will then notify the Commissioner-General of the election and that becomes an objection decision.

The taxpayer may then appeal to the Independent Tax Appeals Board within 30 days of the objection decision. If the taxpayer is dissatisfied with the decision of the Board, appeal to the High Court within 30 days.

What happened between Seadrill and the GRA

After it was served with a tax decision to pay $305m, Seadrill objected to the assessment and asked the Commissioner-General to revise the tax assessment downwards. On 8 July 2020, the Commissioner-General responded to Seadrill with an objection decision by reducing the total assessment from $305m to $22.7m. Seadrill believed there was a need for further reduction and on 28 July 2020, wrote back to the Commissioner-General for a further reduction.

On 1 December 2020, the Commissioner-General granted this request for further reduction and wrote to Seadrill with an updated assessment, reducing the liability further to $17.9m. On 30 December 2020, Seadrill wrote to the Commissioner-General for a third revision of the objection decision. On 24 March 2021, the Commissioner-General refused to revise the objection decision any further and said it was standing by its first revised objection decision issued on 1 December 2020. On 8 October 2021, the Commissioner-General wrote to Seadrill and stood by its position as contained in the 24 March 2021 letter.

Seadrill understood the Commissioner-General’s letter of 8 October 2021 to be the final objection decision and on 8 November 2021, filed a notice of appeal at the High Court, seeking to appeal the objection decision with liability of $17.9m.

What happened at the High Court

At the High Court, the Commissioner-General raised a preliminary legal objection that Seadrill was out of time under all the relevant laws to appeal the objection decision. The appeal should therefore be dismissed. The Commissioner-General said under the Revenue Administration Act, 2016 (Act 915) as amended, Seadrill had up to 30 December 2020, which was 30 days after being served with the objection decision, to appeal.

The Commissioner-General was therefore considering the final objection decision to be the version issued on 1 December 2020. Further, the Commissioner-General said the High Court (Civil Procedure) Rules, 2004 (C.I. 47), which allowed a taxpayer to ask for a three-month extension to file the notice of appeal at the High Court elapsed on 1 February 2021 and so Seadrill’s notice of appeal dated 8 November 2021 could not be saved by any law.

Seadrill’s response was that the final objection decision was not the one dated 1 December 2020 since it continued to engage the Commissioner-General beyond that date. In any case, the title of the letter of 1 December 2020 was ‘Final Tax Audit on Seadrill Ghana Operations Ltd for the 2012 to 2018 years of Assessment’. That did not suggest it was a final objection decision but rather, a tax decision.

In the High Court’s view, the provisions on appeal do not make room for an infinite repetition of objections by an aggrieved taxpayer. An objection decision cannot transform into a tax decision that can be objected to, as the taxpayer claims. Even if the argument of the taxpayer is sustainable, the law requires that every objection to a tax decision must be based on payment of 30% of the disputed tax or evidence of a waiver of this requirement. The High Court reasoned that since that did not happen, there was no fresh objection and so the amended objection decision of 1 December 2020 was the final objection decision.

The count of 30 days and three months should start from this date. The preliminary objection was therefore upheld, and the notice of appeal was dismissed. Seadrill appealed the decision of the High Court.

What happened at the Court of Appeal?

Seadrill tried to convince the Court of Appeal that what the Commissioner-General and the High Court were calling final objection decision was in fact a tax decision. Seadrill argued that Act 915 allowed the Commissioner-General to adjust its own assessment and so any adjustment to an assessment qualifies as a tax decision. Seadrill supported its argument with section 42(9) of Act 915 which provides that,

“In this section, “tax decision” means the tax decision objected to, as may have been amended by an objection decision.”

In Seadrill’s view, the definition in section 42(9) means any adjustment to a tax decision, even if through an objection, becomes a tax decision. The Court of Appeal held that Seadrill’s interpretation is unreasonable and followed the analysis of the High Court by checking the requirements for objecting to any tax decision, i.e., was another 30% paid? The Court of Appeal held that all the letters sent by Seadrill after the 1 December 2020 objection decision could not be considered as part of a new objection and hence are meaningless.

Dissatisfied, Seadrill sought leave of the Supreme Court to appeal again. Despite the Commissioner-General’s opposition, the Supreme Court granted the leave. The appeal at the Supreme Court was heard on 10 February 2026 and judgment is expected on 3 June 2026. This judgment will clarify whether time restarts whenever the taxpayer and the Commissioner-General continue engaging after an initial objection decision.