Case Brief: Kwasi Afrifa v. Ghana Revenue Authority & Attorney-General (SC Reference)

Citation: Reference No. J6/02/2022

Date: 30th November 2022

Court: Supreme Court of Ghana

Coram: Dotse JSC (Presiding), Pwamang JSC, Prof. Kotey JSC, Lovelace-Johnson (Ms.) JSC, Torkornoo (Mrs.) JSC, Prof. Mensa-Bonsu (Mrs.) JSC, Kulendi JSC.

Flynote

Constitutional Law — Administrative Justice — Tax Administration — Objection to Tax Decision — “Pay Now, Argue Later” — Constitutionality of Section 42(5) of Revenue Administration Act, 2016 (Act 915) — Requirement to pay 30% of disputed tax before objection — Discretion to Waive (Section 42(6)) — Whether Section 42(5) violates Article 23 of the 1992 Constitution.

Facts

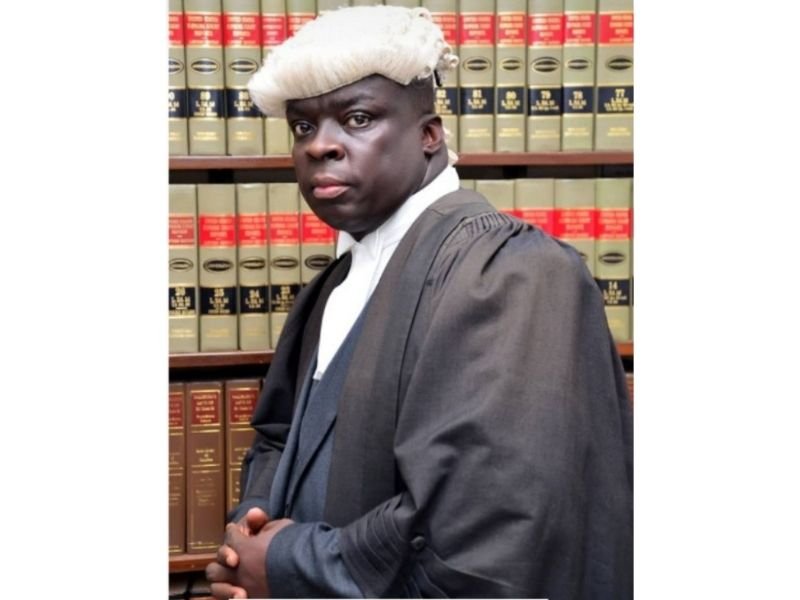

The Plaintiff, a lawyer, was assessed for tax liabilities for the years 2012 to 2016. He objected to the assessment and eventually paid the outstanding taxes, including the statutory 30% of the disputed tax and penalties. Subsequently, in 2019, he applied for a Tax Clearance Certificate (TCC). The Ghana Revenue Authority (GRA) demanded further information regarding his accounts and returns for 2018/2019, stating that without this information, his objection could not be determined.

The Plaintiff filed an action in the High Court, Kumasi, seeking enforcement of his fundamental human rights and administrative justice. He sought a declaration that Section 42(5) of the Revenue Administration Act, 2016 (Act 915), which requires a taxpayer to pay all outstanding taxes and 30% of the disputed tax before an objection is entertained, is inconsistent with the right to administrative justice under Article 23 of the Constitution.

The High Court held the matter was moot as the Plaintiff had already paid the tax. The Court of Appeal reversed this, holding it was a recurring controversy, and referred the constitutional question to the Supreme Court for interpretation.

Issue

Whether upon a true and proper interpretation of Article 23 of the 1992 Constitution, Section 42(5) of the Revenue Administration Act, 2016 (Act 915) is inconsistent with and violative of the constitutional right to administrative justice.

Held (Judgment)

The Supreme Court unanimously held that Section 42(5) of Act 915 is NOT inconsistent with Article 23 of the 1992 Constitution.

Reasoning (Lead Judgment by Torkornoo JSC):

- Statutory Context: The Court held that Act 915 must be read as a whole. While Section 42(5) imposes a condition for entertaining an objection, Section 42(6) expressly grants the Commissioner-General the discretion to waive, vary, or suspend this requirement.

- Fairness and Discretion: The discretion under Section 42(6) is guided by statutory parameters in Section 42(7) (e.g., integrity of the tax system) and constitutional principles of fairness under Article 296. Therefore, the law provides tools to ease the burden on taxpayers, ensuring the system is not absolute or arbitrary.

- Access to Justice: The provision does not close the door to objections. If a waiver is refused, that administrative decision is subject to judicial review. Furthermore, the Act provides an appellate structure (Independent Tax Appeals Board and High Court), ensuring access to justice.

- Proportionality and Public Interest: The requirement to pay a portion of disputed tax is a proportionate limitation necessary for revenue mobilization (public interest) and to prevent frivolous objections, aligning with the citizen’s duty to pay tax under Article 41(j).

Concurring Opinion (Pwamang JSC):

- Agreed that Section 42(5) is constitutional when interpreted within the context of Sections 42(6) and (7).

- Emphasised that if a taxpayer is denied a waiver, they are entitled to apply to the High Court for judicial review or interlocutory relief. The limitation on Article 23 rights is justifiable in the public interest under Article 12(2).

Relevant Legal Provisions Considered

Constitutional Provisions (1992 Constitution):

- Article 23: Right to Administrative Justice (fair and reasonable action).

- Article 296: Exercise of discretionary power (duty to be fair, candid, and not arbitrary).

- Article 41(j): Duty of a citizen to declare income and pay taxes.

- Article 33(1): Enforcement of fundamental human rights.

Statutory Provisions (Revenue Administration Act, 2016, Act 915):

- Section 42(5): Condition precedent for objections (pay outstanding tax + 30% of disputed tax).

- Section 42(6): Commissioner-General’s power to waive, vary, or suspend the 30% requirement.

- Section 42(7): Factors guiding the exercise of discretion (integrity of dispute resolution, protection of revenue).

- Section 41: Definition of Tax Decision.

- Section 44: Appeals to the Independent Tax Appeals Board and the Court.

Loading…

Loading…