Case Brief: Kwasi Afrifa v. Ghana Revenue Authority

Court: High Court of Justice, Kumasi

Suit No: C12/149/19

Date of Ruling: 6th July, 2020

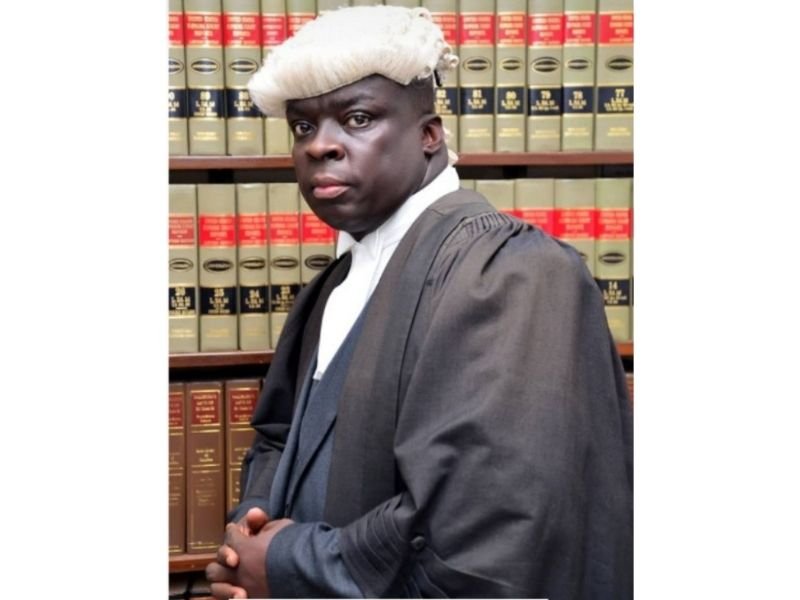

Judge: His Lordship Justice Frederick Tetteh

Flynote

Constitutional Law — Enforcement of fundamental human rights — Article 33(1) of Constitution, 1992 — Whether refusal to issue Tax Clearance Certificate (TCC) violates administrative justice under Article 23 — Tax Law — Whether Section 42(5) of the Revenue Administration Act, 2016 (Act 915) requiring payment of 30% of disputed tax before an objection is entertained is unconstitutional — Mootness Doctrine — Whether an issue should be referred to the Supreme Court under Article 130(2) when the payment has already been made — Practice and Procedure — Substance over form — Commercial disputes disguised as human rights matters — Order 58 of C.I. 47 .

Facts

The Applicant, a lawyer, was served with several tax assessments by the GRA:

- First Assessment (2017): GH₵ 66,932.58. The Applicant objected, but the GRA demanded a 30% prepayment (GH₵ 20,079.77) to hear the objection.

- Second Assessment (2019): After a period of suspension from legal practice, the Applicant was assessed for GH₵ 342,432.49 for 2012–2016.

- Payments: The Applicant eventually paid GH₵ 85,264.68 (including penalties), with some payments marked “without prejudice” to satisfy the 30% requirement.

- TCC Refusal: The Applicant requested a Tax Clearance Certificate (TCC) for medical travel. The GRA refused, citing outstanding returns for 2017–2018, failure to pay all taxes, and non-compliance with information requests regarding client accounts and expenses.

The Applicant filed a human rights application under Article 33(1), challenging the constitutionality of the 30% prepayment rule and seeking an order of mandamus for the TCC.

Issues

- Whether the alleged unconstitutionality of Section 42(5)(b) of Act 915 should be referred to the Supreme Court under Article 130(2).

- Whether the human rights enforcement procedure adopted by the Applicant was appropriate for what was essentially a tax dispute.

- Whether the Applicant was entitled to an order of mandamus for the issuance of a TCC.

Held (Judgment)

The High Court dismissed the application in its entirety and refused the order of mandamus.

Reasoning

- Mootness & Referral: The Court held that since the Applicant had already paid the required 30% of the disputed tax, the constitutional challenge to Section 42(5) was moot. Referring it to the Supreme Court would be “a thoroughly pointless exercise” as no justiciable controversy remained between these parties on that specific point.

- No Ambiguity: Applying the principle in Republic v. Maikankan, the Court found that Sections 42(5) and 42(6) (the waiver provision) were clear and unambiguous when read together, meaning no constitutional interpretation was required.

- Substance Over Form: The Court determined that the Applicant had “camouflaged” a commercial tax dispute as a human rights matter. The proper forum for such a dispute is the Commercial Court under Order 58 of C.I. 47, which handles tax appeals.

- Mandamus: The Court could not compel the issuance of a TCC because the Applicant had not satisfied all statutory conditions under Section 14(3) of Act 915, including filing all returns and resolving underlying disputes through the proper tax objection procedure.

Relevant Legal Provisions Considered

- 1992 Constitution: Article 23 (Administrative Justice), Article 33(1) (Enforcement of Rights), and Article 130(2) (Referral of Constitutional Issues).

- Revenue Administration Act, 2016 (Act 915): Section 14(3) (Conditions for TCC) and Section 42(5) & (6) (Prepayment and Waiver of Disputed Tax).

- High Court (Civil Procedure) Rules, 2004 (C.I. 47): Order 58 (Commercial Claims and Tax Matters) and Order 67 Rule 4(3) (Leave for Further Affidavits).

Loading…

Loading…